Share on social

Highlights

As we approach the 2024 Holiday Season, retailers are navigating a landscape shaped by shifting economic conditions and changing consumer preferences. In this environment, relying on last year’s data to guide supply chain decisions is no longer a viable strategy. Retailers must implement dynamic, real-time forecasting, pricing, and promotional strategies to remain competitive, optimize revenue, and ensure operational efficiency. After all, no one wants to deal with last-minute adjustments or inefficiencies during the busiest time of the year.

“Every retailer, every year is worried about how the holiday season is going to be because it turns out bad their financials are impacted. Retailers that can get the assortments right, get the quantities in the right places, watch how their promotions go… have a better shot at coming out okay,” says Harve Light, President of Churchill Systems Inc.

Here’s a closer look at the key trends and challenges retailers need to consider for the upcoming holiday season and how they can adapt to meet consumer demand.

Strategic Promotion Planning for Price-Sensitive Holiday Shoppers

According to PWC, overall holiday spending is anticipated to rise by 7% this year, but consumer behavior will vary significantly based on individual economic impact. One segment of shoppers, more affected by current economic conditions, is expected to adopt a cautious approach — seekin g promotions or opting for private label, store-brand products, and Chinese shopping apps to maximize value. On the other hand, a less impacted segment is projected to increase their spending compared to 2023, allowing for greater purchasing flexibility for brands that cater to higher-spending consumers. This variance highlights the need for retailers to strategically align their promotional efforts with these distinct spending behaviors.

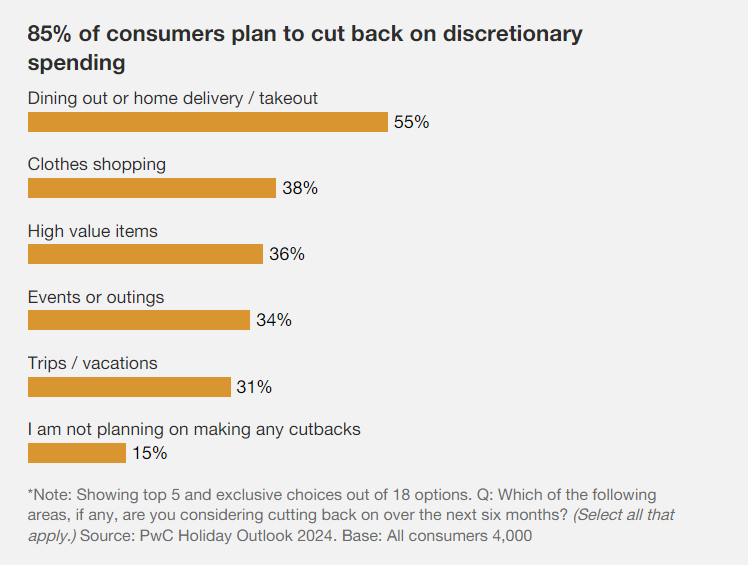

Salesforce research shows that “43% of consumers are carrying more debt than in 2023,” making price sensitivity a key factor in the 2024 holiday season. While inflation has stabilized, many household budgets remain tight, prompting consumers to cut back on unnecessary purchases and scale down the number of items they buy for gifts. Shoppers are becoming more selective, focusing on practical and thoughtful gifts rather than excess. This shift offers both a challenge and an opportunity for retailers: fewer items may be purchased, but well-planned promotions and targeted sales can capture attention and encourage spending within these more cautious, value-driven budgets.

In 2024, consumers are expecting deals during key shopping events like Black Friday, with a growing reliance on money-saving tactics such as coupons and cash-back rebates. To stay competitive, retailers must move beyond historical data and a one-size-fits-all approach.

Traditional methods of demand forecasting, which rely on last year’s sales data or generalized trends will fall short in addressing the nuanced consumer behaviors of this holiday season. Leveraging tools like the Churchill Promotional Demand Forecaster™ is essential in 2024.

What sets the Churchill Promotional Demand Forecaster™ apart is its ability to generate demand forecasts at any level — item, store, day, or week. This precision is vital in today’s market, enabling retailers to avoid stockouts, prevent markdowns, and manage inventory efficiently while maintaining profitability.

Optimizing Inventory for Short-Lifecycle Products in 2024

According to PWC research, holiday spending behavior varies significantly across generations and locations in 2024. Gen Z shoppers are increasing their spending, Boomers are scaling back, and Millennials continue to dominate the holiday spending market. For retailers, this means that tailoring product assortments to these factors is more important than ever.

Regional differences are also evident, with spending projected to increase the most in the South, followed by more moderate growth in the West and Midwest, and only slight growth in the Northeast.

In 2024, as digital marketing costs rise, retailers are shifting their focus toward activating existing customers and reengaging one-time purchasers, rather than relying solely on expensive acquisition strategies. With consumers already familiar with a brand, the key to maximizing revenue lies in offering the right products at the right time in the right place — particularly during the holiday season when short-lifecycle items are in high demand.

Holiday items come with a narrow window of opportunity to capture sales. As shoppers become more selective and value-driven, accurately forecasting demand for these short-lifecycle products is crucial. Misjudging demand can lead to costly markdowns if inventory is overstocked or missed sales if understocked during peak periods.

The Churchill Short Life Cycle Demand Forecaster™ (SLC) is designed to address this exact challenge. Key applications of the SLC include:

- Store Allocation and Replenishment: The SLC helps retailers distribute the right number of seasonal products to each store, preventing stockouts and reducing markdowns.

- Promotions Planning and Execution: As consumer reliance on promotions increases, accurately forecasting how short-lifecycle items will perform during sales events becomes critical.

- Price Optimization: Retailers can strategically price limited-time products based on real-time consumer demand, ensuring profitability without over-discounting.

- Merchandise Planning/Open to Buy: The SLC provides the intelligence to plan seasonal assortments with confidence, adjusting inventory levels as demand evolves throughout the holiday season.

In the 2024 holiday season, where price sensitivity and selective purchasing behaviors are dominant, Churchill’s Short Life Cycle Demand Forecaster™ is indispensable. It allows retailers to avoid the typical risks associated with holiday-specific products by delivering precise insights at every level — item, store, day, and week. This level of detail ensures that retailers can stay agile and responsive, meeting consumer demand exactly when it peaks, without the financial risk of markdowns or stock shortages.

Key Takeaways for a Successful Holiday Season

The 2024 holiday season offers retailers enormous revenue potential, but success will depend on their ability to adapt to the challenges posed by economic conditions and shifting consumer preferences. By leveraging advanced tools like the Churchill Promotional Demand Forecaster v5.2 and Short Life Cycle Demand Forecaster v5.0, retailers can forecast demand more accurately, optimize pricing and promotions, and adjust strategies based on real-time consumer behavior.

These AI-driven solutions ensure that retailers remain agile, efficient, and profitable in an ever-changing landscape, helping them make the most of the 2024 holiday shopping season.