Share on social

Highlights

Retailers are under growing pressure to make forecasting faster, smarter, and more precise. As AI-based forecasting becomes a standard talking point across the industry, many organizations are adopting it reactively — not strategically — driven more by market momentum than by operational need. The gap between promise and performance is becoming harder to ignore.

This article examines three of the most common missteps in AI forecasting implementation — and why avoiding them is essential for long-term success.

Here are a few real-world examples of how that difference plays out:

Mistake #1: Implementing AI Without a Clear Problem to Solve.

Jumping into AI without a clearly defined objective is one of the most common — and costly — mistakes retailers make. Phrases like “we want to leverage AI” or “we’re building an AI strategy” often signal enthusiasm but rarely point to a specific problem that needs solving.

Here are a few real-world examples of how that difference plays out:

- Vague Strategy: “We want to use AI to become more data driven.”

- Clear Forecasting Problem:

“Our team is consistently overbuying spring inventory because we don’t account for regional demand variation. Last year, 60% of our swimsuits sold out in southern markets — but sat untouched in the Midwest.”

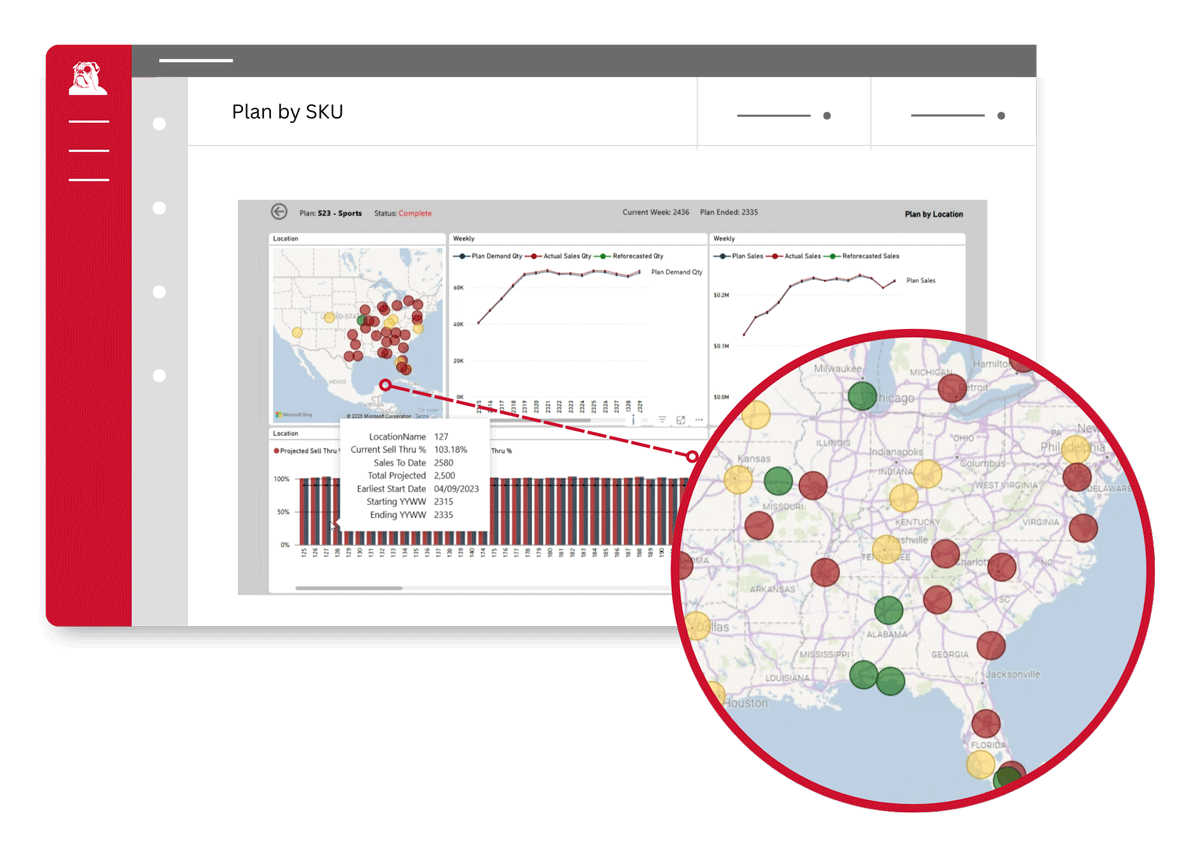

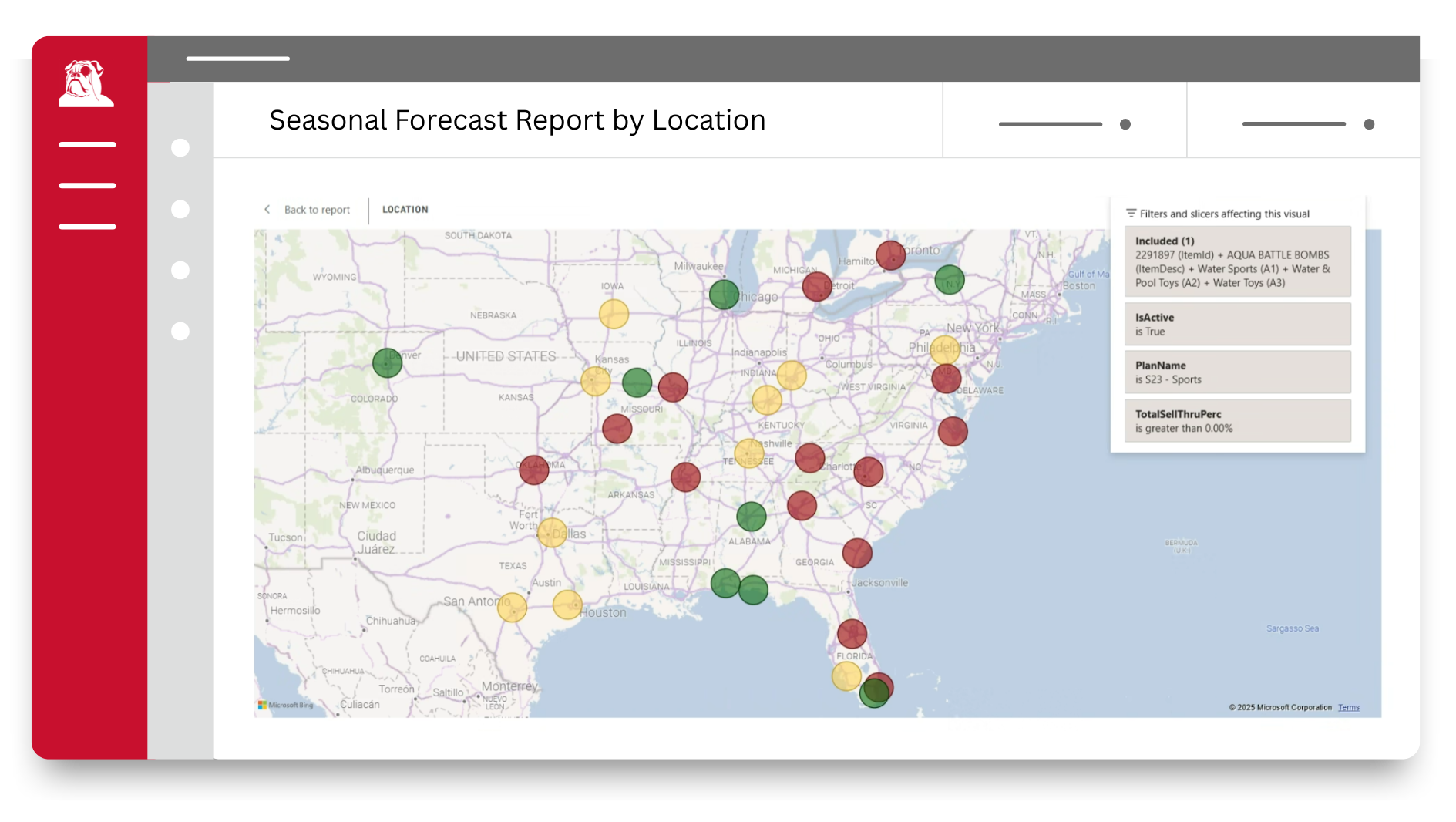

How AI Helps: AI-based forecasting models can create localized demand forecasts down to the store and SKU level, helping planners allocate inventory based on where products are most likely to sell — before they hit the shelves.

Solution: Churchill’s Short Life Cycle Demand Forecaster™ (SLC)

- Vague Strategy: “We’re exploring AI to improve efficiency.”

- Clear Forecasting Problem:

“We always underestimate demand during promotions. We either run out of stock mid-event or overcompensate and get stuck with clearance items.”

How AI Helps: AI models trained on historical sales and promotional data can predict uplift for different types of promotions, accounting for factors like timing, discount depth, and cross-item influence. That means smarter ordering — not overstocking or stockouts.

Solution: Promotional Demand Forecaster™ (PDF), Cannibalization Demand Forecaster™ (CANN)

- Vague Strategy: “We’re investing in AI to help with planning.”

- Clear Forecasting Problem:

“We don’t know how to forecast for new product launches. We treat them all the same, and 70% don’t meet sales expectations — but 10% sell out in the first week.”

How AI Helps: AI can identify patterns in successful vs. failed launches by analyzing comparable products (style, price point, category, seasonality). With that context, it can generate a forecast range based on similar item performance — turning guesswork into calculated risk.

Solution: Profile Cluster Builder™ (PCB), Short Life Cycle Demand Forecaster™ (SLC)

AI-based forecasting can solve major operational and financial pain points — but only when it’s tied to a clear business need. Without that clarity, you’re not buying a solution. You’re buying a buzzword.

Mistake #2: Underestimating the Need for Cross-Team Collaboration.

AI-based demand forecasting isn’t a one-team solution — it’s an organization-wide capability that requires alignment across Merchandise Planning, Supply Chain and Pricing teams. But too often, retailers implement AI-based forecasting within just one department — and expect organization-wide results.

AI works best when it fuels cross-functional decision-making.

When forecasting isn’t connected across teams, the result is misalignment, mistrust, and missed opportunities. Here’s how it plays out in real retail scenarios:

🧩 Example 1: Merchandising Uses AI, But Supply Chain Isn’t Looping In

The Scenario: Merchandise Planning uses AI to predict a 20% spike in demand for women’s denim during fall due to rising search interest and historical sales patterns. They adjust buy quantities accordingly — but never share the forecast with the Supply Chain team.

The Result: Supply Chain sticks to standard lead times and allocation models. The right sizes are delayed at the DC. Stores receive uneven shipments, with some out-of-stock early and others overstocked.

Outcome: Lost sales + markdowns, even though the demand was correctly forecasted.

🧩 Example 2: AI Drives Forecast Accuracy, But Pricing Launches a Surprise Promo

The Scenario: AI-based forecasts correctly estimate steady demand for a high-margin skincare line. The forecast is used to order and allocate just enough inventory to meet expected weekly sales.

But: The Pricing team runs an unplanned 3-day promo across digital and in-store channels without communicating with the planning team.

The Result: Demand surges, stockouts hit Day 2, and replenishment can’t catch up in time.

Outcome: Stockouts + corrupted demand history + strained customer experience.

🧩 Example 3: AI Forecasting Lives in Planning, But No One Downstream Trusts It

The Scenario: Merchandise Planning implements AI forecasting for new product launches and gets promising results. However, Supply Chain and Store Ops still rely on gut feel and manual overrides because they weren’t part of the onboarding, don’t understand the model logic, and aren’t confident in the data.

The Result: They continue over-ordering safety stock, reallocating inventory manually, and ignoring forecasted recommendations — essentially negating the benefits of AI.

Outcome: Wasted resources, bloated inventory, and slow adoption of the new system.

✅ The Fix?

Cross-functional buy-in isn’t a “nice to have.” It’s the difference between a forecast that powers the business — and one that collects dust in a spreadsheet.

Ask yourself:

- Does your pricing team know how forecasting models react to promotions?

- Can supply chain act on the same forecast merch uses?

- Do store teams trust what’s coming down the pipeline?

If not, even the best AI is just another silo.

Mistake #3: Choosing the Wrong Vendor

Just because a vendor knows AI doesn’t mean they understand the retail industry.

Forecasting for retail isn’t just about building a smart algorithm. It’s about knowing how demand really behaves — across hundreds of thousands of SKUs, multiple locations, volatile promotions, and constantly changing assortments.

It’s not enough for a vendor to specialize in AI — they must also understand the operational realities of retail. If they don’t account for halo effects when modeling demand or fail to differentiate between forecasting approaches for long-life versus short-life products, they may be applying generic solutions to highly specialized challenges. True forecasting success requires both technical expertise and deep retail domain knowledge.

Choosing the right AI partner means choosing someone who knows how to think like a retailer.

In today’s hype-driven market, it’s easy to mistake novelty for expertise. AI isn’t new. At Churchill, we’ve been using and refining AI models for over 35 years — long before it became a buzzword.