Share on social

Highlights

The Pattern We Heard at NRF 2026

At NRF 2026, we heard the same conversations repeated across dozens of retailer meetings.

“Stores are getting the wrong assortments.”

“Our allocation just isn’t working.”

“Promotions are falling flat.”

“Replenishment always feels reactive.”

Retailers described different problems, with pressure surfacing in different parts of the organization. But after enough of these conversations, a clear pattern emerged.

What stood out wasn’t the variety of challenges – it was how often they all traced back to the same underlying issue: an unreliable demand forecast.

Poor Visibility Into Demand Affects Everything Downstream

Assortment, Allocation & Replenishment, Promotions & Markdowns – these functions are deeply interconnected. Every one of them depends on a single key factor: customer demand.

What will customers buy, where will they buy it, when, and at what price?

When demand forecasting is inaccurate, incomplete, or overly aggregated, decision-making starts to deteriorate:

- Planning becomes assumption-driven

- Execution becomes reactive

- Optimization tools technically “work,” but results don’t improve

In these situations, retailers don’t actually have an allocation problem or a pricing problem. They have a demand forecasting problem.

Symptom #1: Merchandise Planning Feels Like Guesswork

What retailers are seeing:

- Seasonal item sell-through rates miss expectations

- New items and special buys either sell out immediately or never gain traction

- Assortments don’t align with the needs of individual locations

What’s actually happening:

Seasonal planning is often where the first cracks appear – not because retailers lack planning processes, but because they lack confidence in their projections.

Many retailers enter the pre-season planning phase without a demand forecast they fully trust. Historical data is fragmented, incomplete, or inconsistent across teams and systems, leading planners to rely on broad averages or intuition instead of a fully-vetted set of demand models and algorithms.

On the surface, this is often framed as a Purchasing or Assortment issue.

In reality, the issue is a lack of a trusted, granular demand forecast to guide those decisions pre-season.

Symptom #2: Store-Level Allocation & Replenishment Never Feel “Right”

Allocation and Replenishment are often where frustration becomes most visible.

What retailers say:

- “Some stores sell out immediately while others sit on inventory.”

- “Replenishment feels reactive instead of proactive.”

- “Inventory is moved multiple times before it finds the right home.”

Teams feel like they’re constantly chasing demand instead of staying ahead of it, and by the time they react, it’s already too late. Adjustments are constantly made – often at the expense of margin, transportation and labor costs, and customer satisfaction – yet the underlying problem never fully goes away.

What’s really broken:

The breakdown begins with initial allocation that isn’t optimized against true store-level demand. From there, every downstream decision becomes reactive by default.

Without timely demand signals and early warning indicators, replenishment is forced into correction mode – responding to yesterday’s sales rather than anticipating tomorrow’s needs.

Inventory is moved between locations at an extra cost, and each further adjustment compounds cost of goods, while delivering diminishing returns.

This creates a snowball effect: misplaced inventory leads to reactive decisions, which lead to further distortion, and ultimately more intervention.

Symptom #3: Promotions & Markdowns Underperform

Retailers often turn to pricing and promotion tools to fix performance issues, assuming the challenge lies in execution.

The uncomfortable truth: Pricing and promotion tools assume you already understand demand behavior.

So even after implementing new pricing solutions, retailers say:

- “Promotions aren’t delivering the lift we expected.”

- “We’re eroding margin without seeing real gains.”

- “We can’t tell what actually worked versus what just shifted demand.”

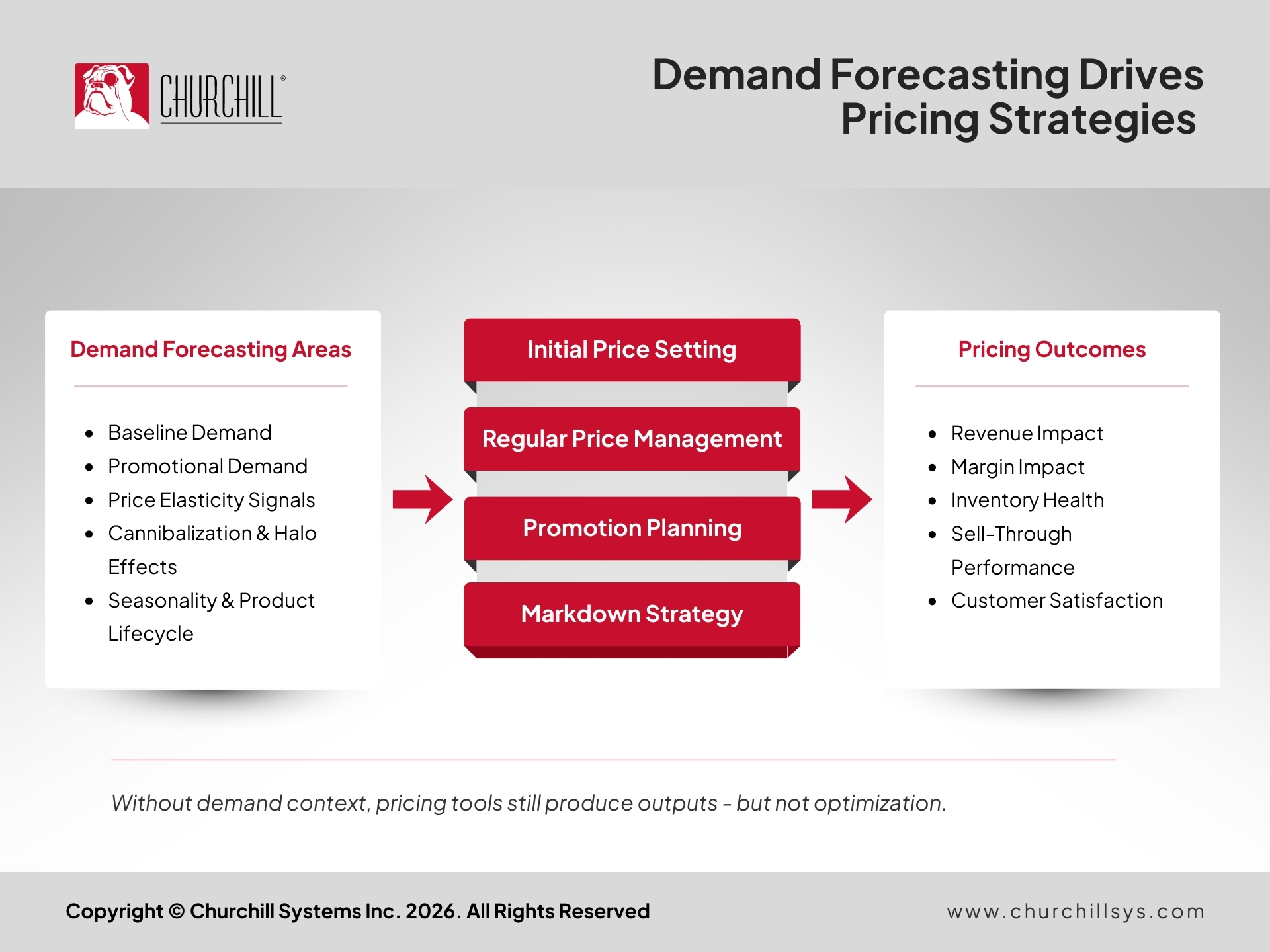

If demand forecast isn’t reliable, promotions and pricing tools lack the visibility required to optimize – meaning lift can’t be maximized, halo and cannibalization can’t be reliably measured, and markdown decisions remain reactive.

Promotions don’t fail because the tools are wrong. They fail because they lack a sound view of demand.

Price optimization without reliable demand signals becomes guesswork.

When demand forecasting is right:

- Merchandise planning becomes customer-focused

- Allocation becomes targeted

- Replenishment becomes proactive

- Promotions become a strategic tool

- Markdowns protect margin through precise application at the store level

Fix the forecast – and the symptoms resolve themselves.

A Better Question for 2026

Instead of asking why a promotion didn’t work, why inventory is stuck in certain stores, or why planners keep overriding the system, there’s a more powerful question to ask:

Do we actually trust the demand forecast driving these decisions?

The most forward-looking retailers aren’t chasing individual forecasts. They are rethinking how demand is understood – end to end – and adopting the tools necessary to convert demand into sales with every decision they make.