Share on social

Highlights

Here’s the retail paradox:

Every retailer wants better forecasting…

yet most forecasting upgrades stall before they even begin.

What does it really take to modernize demand forecasting in 2026?

Retail leaders agree on one thing: better forecasting is no longer optional.

Margins are tighter. Inventory is more expensive to carry. Promotions are noisier.

Volatility is the new normal — and the legacy forecasting tools simply can’t keep up.

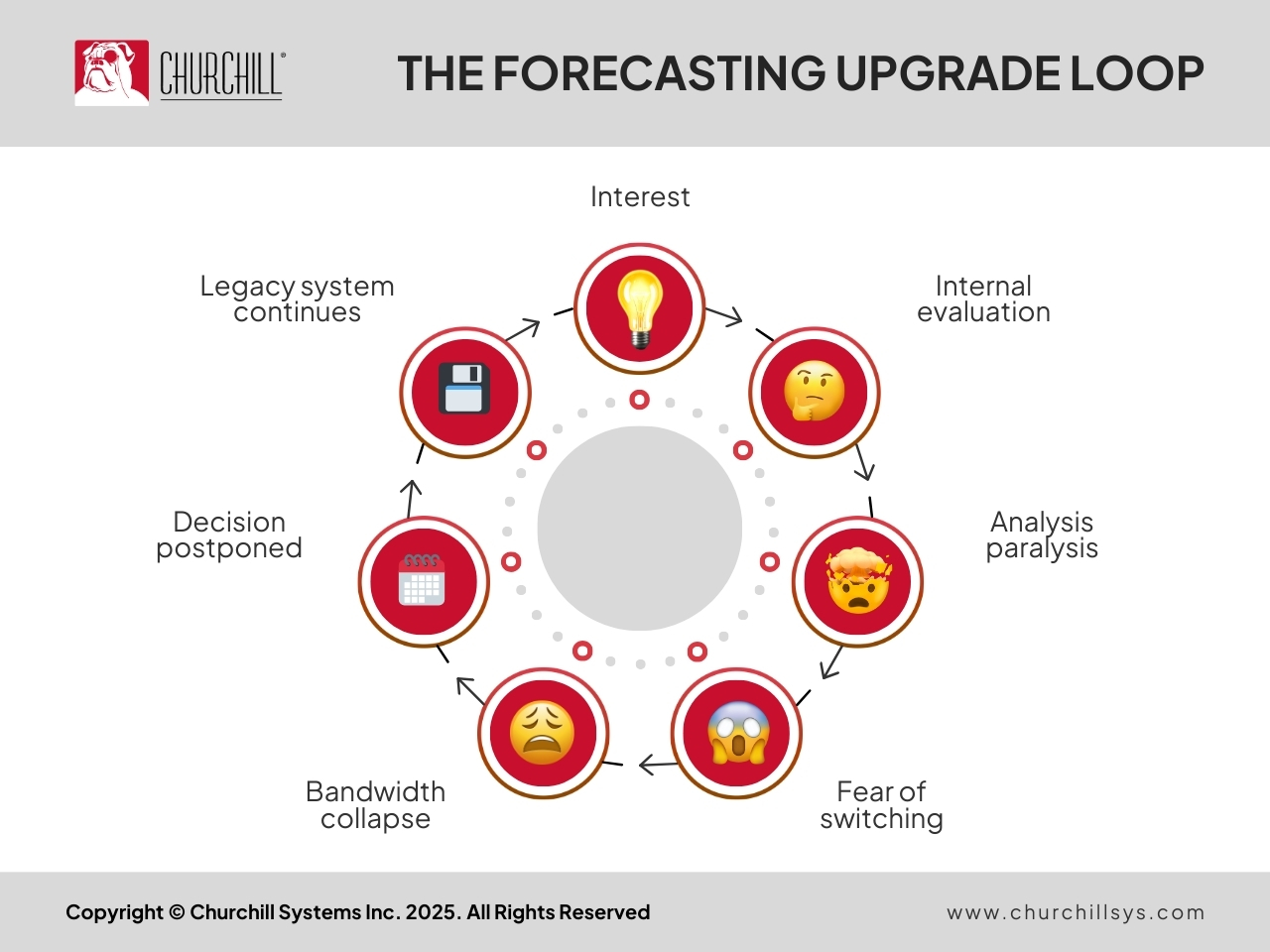

If you’ve ever tried to evaluate new forecasting tools internally and felt the process drag on, stall, or collapse entirely, you’re not alone. Churchill speaks to hundreds of retailers every year, and the pattern is always the same.

The Real Reason Retailers Hesitate to Modernize Demand Forecasting

A major reason retailers hesitate to upgrade forecasting tools is simple: they already have something in place.

It may be outdated, it may rely on legacy logic. It may even require endless manual overrides. But it’s there. It’s implemented. People know how to use it, they’ve trained around it, and entire workflows have grown around its limitations.

And even if everyone quietly agrees, it’s not perfect, or even particularly good, but it’s familiar.

This creates an incredibly powerful psychological and operational barrier.

Why risk switching to something new — even if it’s better — when we’ve already adapted to the old?

This is the silent killer of innovation in retail forecasting:

the comfort of the known beats the potential of the improved.

The problem, of course, is that “comfortable but limited” systems quietly leak margin, misread demand, and force teams into unnecessary manual work. But because the pain is spread across the organization — in small daily inefficiencies — it rarely triggers urgency.

Why Retailers Don’t Trust New Forecasting Tools

Retailers aren’t afraid of innovation, and they don’t resist change because they’re inherently conservative in their approach. When they hesitate to adopt new forecasting tools, that hesitation is rooted in experience.

Most retailers have been burned by:

- technology experts with little retail expertise

- long implementations

- tools that required full operational overhauls

- disrupted workflows

- internal budget freezes that stalled or killed initiatives mid-stream

- solutions that simply didn’t solve the problems they claimed to fix

So, the default attitude is: “If what we have works just well enough, we won’t risk it.”

The Hidden Barrier: Retail Teams Running at Full Capacity

Retail planners, merch teams, and supply chain directors aren’t short on intelligence or motivation — they’re short on time. Today’s retail environment demands nonstop decision-making. With millions of SKUs, thousands of stores, and an always-on promotional calendar, teams are already operating at maximum capacity.

- 500K+ SKUs

- 500+ stores

- hundreds of promotions

- meeting-heavy organizations

- zero bandwidth for “evaluation”

They’re exhausted and don’t want another demo, platform, or dashboard.

So How Do Retailers Break The Cycle?

1. Start with a small, low-risk pilot

Not a full implementation, but a focused 6–12-week project with minimal resource requirements. Small enough to be manageable – big enough to prove value.

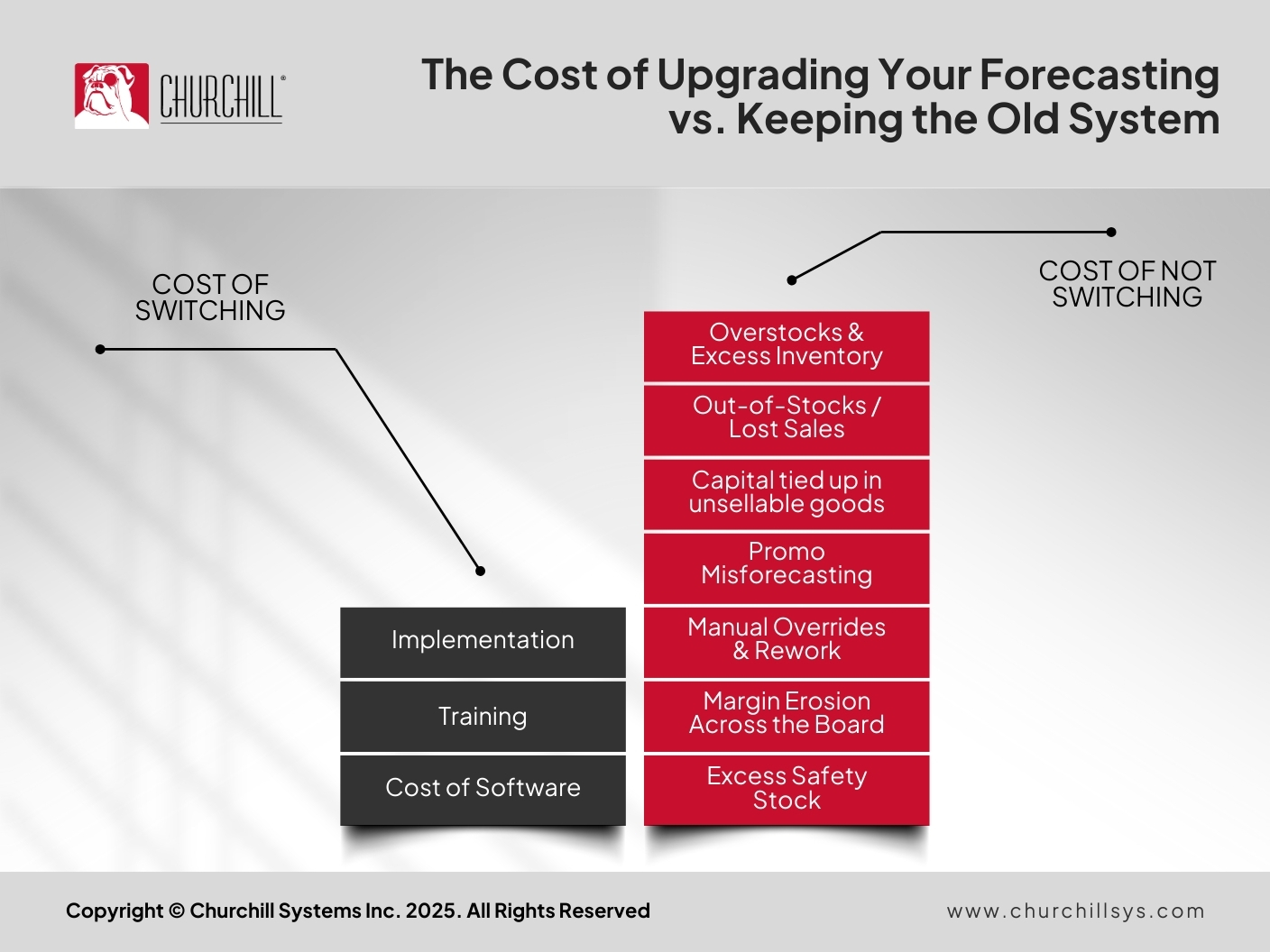

2. Quantify the cost of inaccuracy

Forecasting doesn’t just influence operations – it directly impacts margin. For mid-market retailers, every 1% of error equals $2–4 million in lost margins.

3. Choose vendor that specializes in retail

Effective forecasting requires more than sophisticated math. It requires a deep understanding of how merchants plan, how supply chain executes, how pricing moves, and how those functions interact under pressure.

4. Choose tools that planners WANT to use

Executives make the purchasing decisions – but planners live with these tools every day. If the system isn’t intuitive, fast, and easy to work with, adoption will stall no matter how advanced the technology is. Ease of use matters just as much as accuracy.

5. Align Merch, Supply Chain, and Pricing around one demand forecast

Most duplicate work in retail isn’t caused by bad data – it’s caused by different teams using different versions of the forecast. A unified view of demand can eliminate 20–40% of unnecessary back-and-forth

Why Switch Now

- “Good enough” forecasting is the most expensive kind

- “Every 1% of forecast error costs up to $2–4M in lost margin”

- Forecasting bias is silent – until it becomes a margin leak

- Your teams don’t need more dashboards. They need better demand clarity

- If Merch, Supply Chain, and Pricing use different forecasts, the business pays three times

- Legacy tools weren’t built for modern volatility

- Improper new item forecasting is a hidden tax on growth

- Promo forecasting is one of the biggest margin leaks – fix that, and everything improves

- The cost of NOT switching is growing faster than the cost of switching

Conclusion

Modernizing forecasting isn’t about ripping out systems or chasing the newest buzzword. It’s about removing the barriers that keep retailers stuck: legacy comfort, lack of trust, and overwhelmed teams.

The retailers who win in 2026 will be the ones who take a practical, focused approach – small pilots, unified demand signals, measurable ROI, specialized partners, and tools planners actually want to use.